BlackRock Abruptly Pulls Shareholder Notices From NZ Exchange

[ad_1]

After announcing an ambitious green investment in New Zealand, it appears as if BlackRock, the world’s top asset manager, has made a rookie mistake.

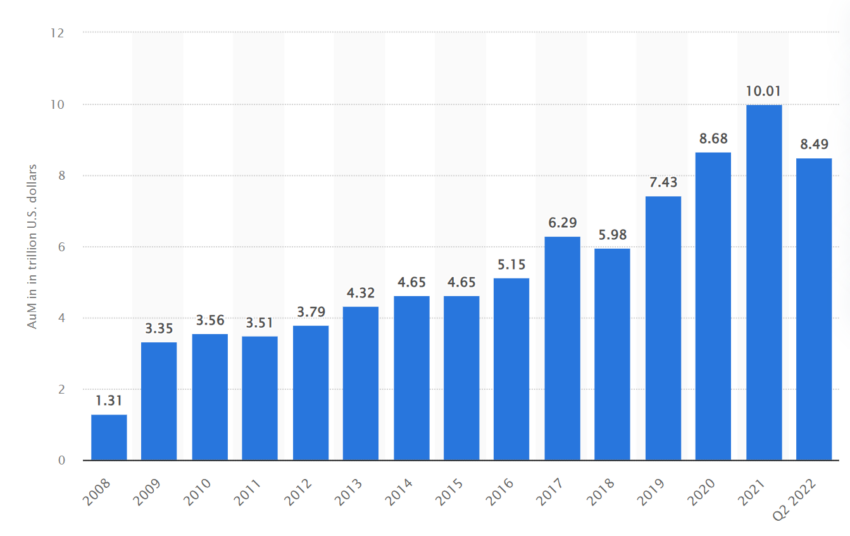

BlackRock, which had US$8.59 trillion in assets under management as of December 31, 2022, currently awaits approval of its spot Bitcoin ETF from the Securities and Exchange Commission (SEC). The ETF is likely to be the first of its kind in the United States. So, one of the last things it needs is bad PR.

BlackRock Retracts Shareholder Notices for 11 Firms

Updates posted on NZX, the national stock exchange of New Zealand, on August 10, appear to show BlackRock retracting substantial shareholder notices regarding on several NZX-listed companies.

According to the New Zealand Herald, a BlackRock spokesperson said that administrative error had come into play. In the case of Vital Healthcare Properties Trust, BlackRock had not actually bought into the company, the spokesperson acknowledged.

The shareholder notices related to 11 NZX-listed companies. They were, in alphabetical order, A2 Milk, Auckland Airport, Contact Energy, Goodman Property, Oceania Healthcare, Pacific Edge, Property for Industry, Ryman Healthcare, Stride Property, Summerset, and Vital Healthcare.

SSNs are used to inform the market when an individual or entity accumulates a large stake in a company’s shares. These notices help provide market transparency, prevent hidden ownership, and supply investors with timely information.

At least that’s how it is supposed to work. If you thought that blue-chip asset managers are infallible, think again.

A Big New Green Investment Deal

The news comes just days after BlackRock announced it was investing $1.22 billion in a climate infrastructure fund. One of the most ambitious green initiatives from the asset manager in a single country, relative to its size.

In a LinkedIn post, the chairman and CEO, Larry Fink, called it “the largest single-country low-carbon transition investment initiative BlackRock has created to date.”

Frankly, it’s a PR move the company is in dire need of. BlackRock has taken heavy flak for hypocrisy on climate issues in recent weeks.

Since 2017, the financial giant has sought to position itself as a leader in sustainable investing. More than anything else, it has led the way in incorporating environmental, social, and governance (ESG) standards into American capitalism. “Climate risk is investment risk,” says the firm’s website.

However, on July 17, BlackRock revealed it was adding Amin Nasser, former head of Saudi Aramco, one of the world’s leading oil firms, to its board. Never mind Aramco’s record on the environment.

BlackRock is currently waiting for the SEC to approve its spot Bitcoin ETF. It was the first to submit the latest round of applications on June 16.

Invesco, WisdomTree, ARK Invest, Valkyrie, and several others, followed soon after. BeInCrypto recently reported that the pending approval was a matter of “when, not if.” But if BlackRock continues to undermine its own credibility, who can say?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link