What Are the Challenges of Raising Capital in the Crypto Industry?

[ad_1]

The cryptocurrency industry faces a stark reality. Raising capital is increasingly becoming an uphill battle. Venture capital investments in crypto-related endeavors are significantly declining.

As highlighted in a recent report, just eight venture capital funds focused on crypto had raised a combined $500 million globally as of May 16, 2023. This marks a 90% drop in funds to receive financial backing compared to the previous year. So, what is causing this crunch in crypto financing, and how is it reshaping the industry?

Venture Capitalists Funding Declines

Maarten Bloemers, co-founder of GET Protocol, provides a candid perspective on the declining sum of venture capitalists investing in crypto and blockchain startups.

“VCs are currently occupied with the challenge of sustaining their existing portfolio companies, which leaves them with limited capital to allocate towards new investments,” Bloemers told BeInCrypto.

Bloemers’ insights point to an unnerving situation. Due to the current adoption curve, venture capitalists might encounter difficulties finding limited partners for new Web3 funds, potentially quelling growth opportunities for the crypto industry in expanding adoption.

Over the past year, various crypto venture capital firms’ assets under management (AUM) have experienced significant declines. For instance, Multicoin’s AUM plummeted from an initial figure of approximately $8.9 billion to a much lower $1.4 billion by the end of 2022.

Similarly, Paradigm saw its AUM decrease from a substantial $13 billion to an estimated $8.7 billion during the same timeframe, according to data from Newcomer.

While AUM may not be the definitive metric for assessing a firm’s prosperity and can vary due to factors unrelated to the fund’s performance, it remains a valuable indicator of financial health.

The ripple effects of these developments are widespread. Following the spectacular collapse of centralized exchanges like FTX and subsequent banking crises, regulators have redoubled their scrutiny of the crypto industry.

In June, the United States Securities and Exchange Commission (SEC) sued Binance, the world’s largest crypto exchange. Bloemers sees a striking dissonance in this. He is confounded that “we have all the tools not to be dependent on central parties in the ecosystem, but we do not use them,” urging a return to crypto’s foundational ethos.

The Role of Artificial Intelligence

Besides regulatory tightening, a notable shift in venture capital attention is apparent from crypto to artificial intelligence (AI).

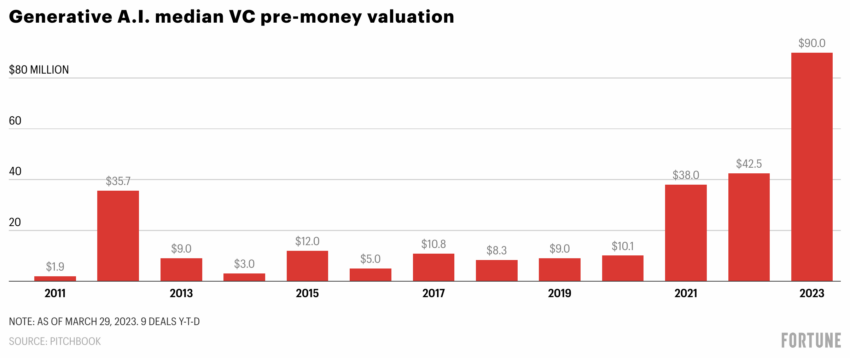

Fortune reported a significant surge in the median pre-money valuation for generative AI companies. This valuation has skyrocketed to $90 million as of the current year, based on the nine deals that PitchBook has recorded through to March 29. This marks a substantial increase from the $42.5 million figure recorded for 2022.

Notable deals involving companies such as Anthropic and Tome have increased in numbers. Moreover, early-stage AI startups focusing on various applications, including software development, customer experience enhancement, and media creation, are also receiving high valuations.

Read more: These Three Billionaires Are Bullish on Artificial Intelligence, Bearish on Crypto

Bloemers reframes this trend as more of a responsibility on the crypto industry to pivot than a betrayal by VCs.

“Don’t blame a dog for barking, VC’s will VC,” he says, challenging the industry to “build something that can onboard the next billion users” as a counterstrategy.

He dismisses the idea of crypto projects integrating AI components merely to woo investors. Instead, he encourages building “because it adds value to a large enough market.”

Increasing Regulatory Scrutiny

Bloemers is particularly unwavering about the resilience of the crypto industry amidst regulatory pressures. “I personally do not believe that ‘the powers that be’ want to destroy crypto,” he reflects. Rather, he considers the current regulatory storm transitory, a period in which regulators grapple to understand a novel, complex industry.

“It takes time for regulators to catch up and truly understand what it is that is being built,” Bloemers believes.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

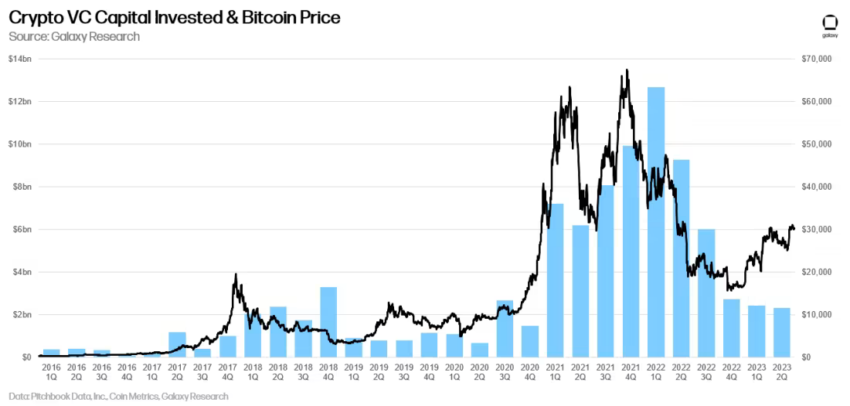

Galaxy Digital revealed that venture capital funding for crypto startups continues to drop for the fifth consecutive quarter as regulation unfolds.

“The crypto and blockchain sector saw $2.32 billion invested in Q2 2023, marking a new cycle low and the lowest since Q4 2020, continuing a downtrend that began after a peak of $13 billion in Q1 2022. Crypto and blockchain startups raised less money across the last three quarters combined than they did in just Q2 of last year,” reads the report.

Still, US-based crypto startups have maintained a significant share of interest from VC firms. They have attracted 45% of all capital investments in the crypto industry. This is despite the growing regulatory scrutiny faced by crypto firms in the United States.

For new entrants into the crypto space who might feel disheartened by the current funding challenges, Bloemers offers sound advice.

“Make your product easy to use for the general public and make them love it,” he says.

The challenges of raising funds in the crypto industry are multi-pronged. They are shaped by regulatory uncertainties, cautious investors, and global economic headwinds. However, for industry veterans like Maarten Bloemers, this period is less an existential threat and more a call for introspection and adaptation.

Read more: Top 11 Public Companies Investing in Crypto

As Bloemers sums it up succinctly, navigating the crypto market, especially in these times, is “a marathon, not a sprint.”

And in this marathon, a return to the roots and ethos of crypto could prove to be the most potent form of endurance. Building not for speculative hype but for substantial, transformative value.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link