Market Aversion Leads to $864.24 Million Crypto Liquidations

[ad_1]

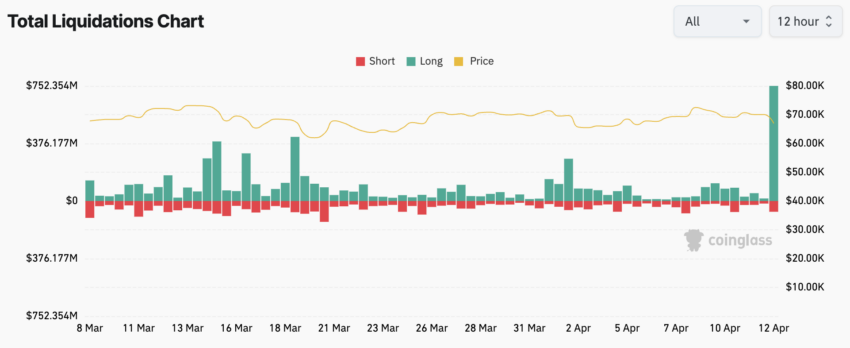

In a stunning reversal of fortune, the crypto market saw a significant downturn, culminating in a whopping $864.24 million worth of liquidations.

$864.24 Million in Crypto Liquidations

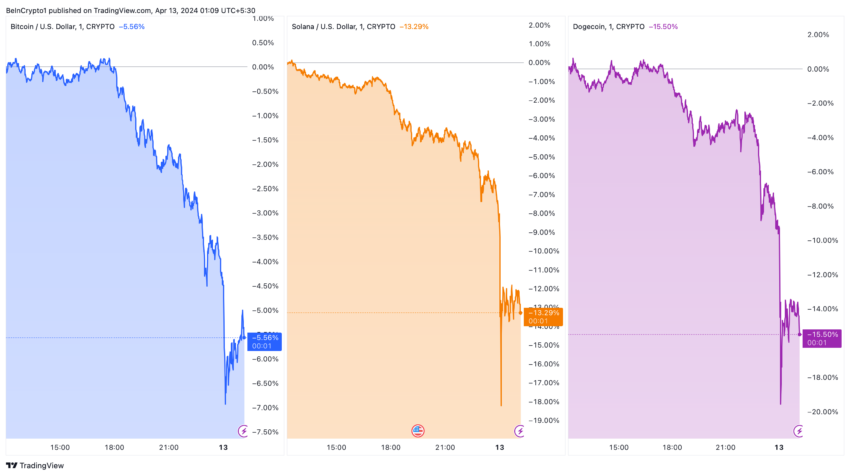

Bitcoin led the correction, falling 7% to a weekly low of $65,214. This downturn marks its lowest valuation since April 5.

The ripple effects resonated across the board. Even smaller cryptocurrencies like Solana and Dogecoin experienced steeper declines of around 18% and 19%, respectively.

The downturn primarily stems from the liquidations of bullish bets on crypto.

In the past 24 hours alone, data from Coinglass indicates that approximately $775.40 million was cleared from long positions in derivatives markets. Short positions were not spared either, with around $89.89 million being liquidated.

This sudden market shift contrasts sharply with the recent uptrend fueled partly by anticipation surrounding the Bitcoin halving event—a key update in the cryptocurrency’s code meant to decrease its supply.

Despite the current crypto liquidations, Bitcoin remains substantially higher for the year, boasting an approximate 60% increase.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link